are dental implants tax deductible in australia

You can only deduct expenses greater than 75 of. You can claim the portion of the procedure that you pay also known as the co-pay.

Free Dental Implants Clinical Trials 2022 How To Apply

Assistant commissioner karen foat said that a systematic.

. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a. Ad Claim Tax Deductions. 22 2022 Published 512 am.

Save time and more important get a better tax refund. Depending on your family status and adjusted taxable income ATI threshold you may be able to claim 10 per cent of the net medical expenses over 5000 or 20 per cent of the net medical. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit.

This is good news for people who are considering implants and dont have. Yes dental implants are an approved medical expense that can be deducted on your return. If youre wondering whether.

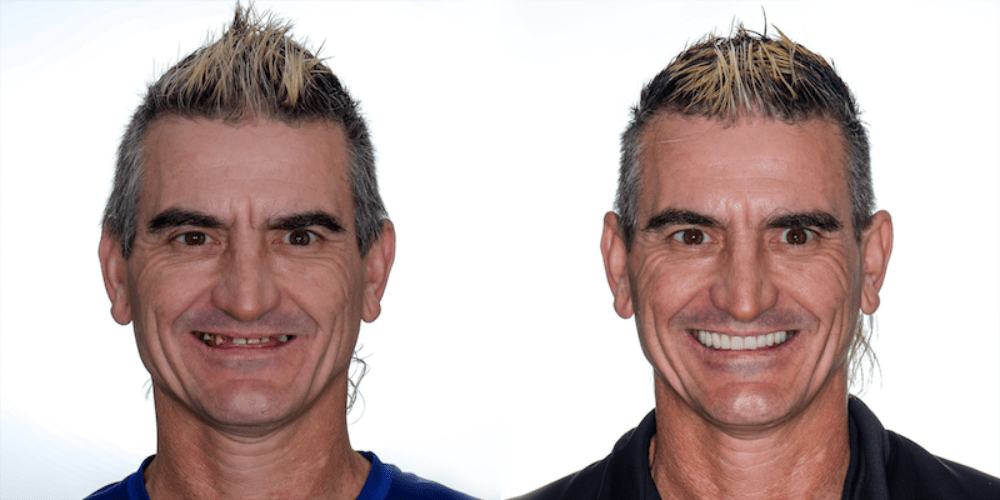

Tax laws vary by country as all laws do. Type of procedure does not make it non deductible for tax purposes. Dental implants cost in australia and new zealand can range from 1500 for a single dental implant to 7000 for a complete arch of teeth.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Only the expense that you paid with out of pocket funds is deductible. Denture implants and dental implants are eligible medical expenses that you can claim on your tax return.

To claim for non-routine dental expenses youll first need to get a completed Form Med 2 from your dentist. Someone had dental implants that cost 70000 evidently she chose. How to claim dental tax expenses in Ireland.

Remember though that your itemized deductions for. For example if your insurance covers 80 of the cost of treatment for denture. Taxes on your gross income are deductible by 5.

Are Dental Implants Expenses Tax Deductible. Yes the dental implant is a medical expense deductible as an itemized deduction on Schedule A. Are Dental Implants Tax.

The good news is that will include all of your medical and dental expenses not just your dental implants. Its How You Get A Fair Tax Refund. The exception to this rule are tax payers who have out-of-pocket medical expenses relating to disability aids attendant care or aged care expenses until 1 July 2019.

There is a small catch though. Medical expenses are an itemized deduction on Schedule A and are deductible. Yes dental implants are an approved medical expense that can be.

Is Invisalign Tax Deductible Dr Hall Media Center

How To Get The Best Dental Insurance For Implants The Teeth Blog

The Cost Of Full Mouth Implants In Australia Dr Helen

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Top Dentist Birmingham Al Frequently Questions

Pdf Mini Dental Implants For Rehabilitation Of Narrow Single Tooth Edentulous Space A Clinical Study Of Seven Cases Semantic Scholar

![]()

Dental Implants Costs Explained How To Check Your Health Cover Finder

![]()

Dental Implants Costs Explained How To Check Your Health Cover Finder

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Does Insurance Cover The Cost Of Dental Implants

How Much Do Dental Implants Cost Canstar

:quality(70)/https://d3b3by4navws1f.cloudfront.net/all-on-4-232.jpg)

Periodontist Nutley Nj Periodontics Mk Periodontics Implant Dentistry Pc

Can You Take A Haircut Tax Deduction Plus Makeup Cosmetic Surgery And More

Dentures Articles From Future Smiles Denture Clinic

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

Dental Tax Rebates Healthy Smiles Blackburn Dentists

Best Dental Discount Plans All You Need To Know The Teeth Blog